Author(s): Ravirajapandiyan V.

Paper Details: Volume 3, Issue 4

Citation: IJLSSS 3(4) 54

Page No: 722 – 762

ABSTRACT

The impact of household saving on the economy is a topic of great importance in the field of economics. Saving is the difference between income and consumption, and it plays a crucial role in economic growth. When households save, they make funds available for investment, which in turn leads to increased capital formation and economic growth. The impact of household saving can be seen in various aspects of the economy. For example, it helps finance investment in new businesses, which can lead to job creation and higher levels of productivity. It also contributes to the stability of financial markets by providing a pool of funds for investment. Prior to the 20th century, saving was a crucial means of securing one’s future and providing for emergencies, given the lack of social safety nets and other forms of financial protection. In agrarian societies, households often saved in the form of crops or livestock, while in industrialised economies, savings accounts and other financial instruments became more prevalent. To understand changes in economic policies, such as tax incentives. To find the difficulties faced by public people on household saving The research method followed here is empirical research. A total of 210 samples have been collected out of which all samples have been collected through convenient sampling methods. The sample frame taken here is public areas in and around Chennai. The independent variables are age, gender,education qualification, employment status, marital status. The dependent variables are primary reasons for saving money , financial emergencies that required the use of your savings , main Drawbacks of saving money , savings habits have impacted your overall financial wellbeing. The impact of household saving is significant and can have wide-ranging effects on both individuals and the broader economy.

KEYWORDS

Economic growth, investment, emergency funds, Retirement, Debt reduction, education, social welfare

INTRODUCTION

Historical context: Prior to the 20th century, saving was a crucial means of securing one’s future and providing for emergencies, given the lack of social safety nets and other forms of financial protection. In agrarian societies, households often saved in the form of crops or livestock, while in industrialised economies, savings accounts and other financial instruments became more prevalent. Post-WWII era: In the decades following World War II, there was a significant increase in household saving rates in many developed countries, driven by factors such as rising incomes, lower household debt levels, and increased confidence in social welfare programs. However, this trend began to reverse in the 1980s and 1990s, as consumers became more reliant on credit and household debt levels rose. Global financial crisis: The 2008 financial crisis had a profound impact on household saving, as many households saw their retirement savings, home values, and other assets decline significantly. This led to a renewed focus on saving, both as a means of financial security and as a way to help support the broader economy. Technological innovations: In recent years, technological innovations such as mobile banking and digital financial tools have made it easier for households to save and manage their finances. This has also opened up new opportunities for financial institutions and policymakers to encourage saving often to the behavior through the targeted messaging, incentives, and other interventions. Current challenges: Today, many households face significant challenges when it comes to saving, including rising inequality, stagnant wages, and the high cost of living in many urban areas. As a result, policymakers and financial institutions are exploring new ways to promote saving, such as automatic enrollment in retirement plans, income-based savings incentives, and other measures designed to make it easier and more attractive for households to save.Retirement savings programs.

OBJECTIVES

- To understand how changes in economic policies, such as tax incentives

- To find the difficulties faced by public people on household saving

- To find out the negative impact of household financial saving

REVIEW OF LITERATURE

MARIA ASLAM(2022)

household saving behaviour in urban and rural areas of Pakistan. The study obtained microdata from the Household Integrated Economic Survey (HIES) 2018-19 and Pakistan Social Living Standards Measurements Survey (PSLM) 2018-19 conducted by the Pakistan Bureau of Statistics (PBS). A nationally representative sample of 5499 households is selected, 3155 from rural areas and 2344 from urban areas by using systematic sampling. The impact of socioeconomic and demographic characteristics on household

JINGWEN(2022)

We use provincial panel data on China for the 2002-19 period to conduct a spatial autocorrelation analysis of household saving rates as well as a dynamic panel analysis of the determinants of household saving rates using a spatial Durbin model. To summarize our main findings, we find that, in China, the household saving

RAHMANDA MUHAMMAD THAARIQ(2021)

The impact of access to the internet and household saving behaviour, in the context of the amount of savings and the saving preferences, in Indonesia. Using the fifth wave of the Indonesia Family Life Survey data, this study finds that there is a positive effect between internet access and household savings

GULSHAN MAQBOOL(2021)

Energy-saving behaviours are defined as the daily and habitual practices of households that focus on specific reductions in energy use. The main objective of this research was to estimate the impact of the energy-saving behaviour of individuals on energy demand and to estimate the impact of factors affecting the adoption

ADAN L(2020)

whether habitual energy saving behaviours of a household head impact actual energy consumption in his/her own dwelling. In doing so, this paper compares actual energy consumption across French households that, with exception of household heads’ energy saving behaviours, are similar in observables –including household composition and dwellings’ energy efficiency

MUHAMMAD IDREES(2020)

The impact of foreign capital inflows (FDI, RT and FA) on household savings of Pakistan. Data used in this study has been obtained from the website of State Bank of Pakistan for the period of 1981-2010. Statistical tools including multiple regressions analysis were applied for analysis. Results explain that foreign direct investment (FDI), remittances (RT) are having positive and significant impact on household saving (HS) but foreign aid (FA) is having negative and insignificant impact on household saving

CHADWICK(2017)

We use a model of household life-cycle saving decisions to quantify the impact of demographic changes on aggregate household saving rates in Japan, China, and India. The observed age distributions help explain the contrasting saving patterns over time across the three countries. In the model simulations, the growing number of retirees suppresses Japanese saving rates, while decreasing family size increases saving for both China and India.

VIVIEN BURROWS(2017)

Household consumption by focusing on their impact on mortgage equity withdrawal and household saving. Household-level data are used to derive a measure of expected and unexpected changes in house prices; these are then incorporated into a recursive bivariate probit model of the decision to withdraw housing equity and save. The results suggest that households respond to changes in their housing wealth primarily by increasing their mortgage borrowing, rather than by decreasing their savings, although this is mainly for younger households. However, while changes in housing wealth do not have a direct impact on household

CHARLES YUJI HORIOKA(2016)

This paper estimates a household saving rate equation for India and Korea using long-term time series data for the 1975-2010 period, focusing in particular on the impact of the pre-marital sex ratio on the household saving rate.

ADEMA, YVONNE(2016)

We investigate the cyclicality of the household saving to household disposable income ratio for a panel of 16 OECD countries over the period 1969–2012. We find evidence that the household saving ratio is countercyclical. We empirically investigate whether the determinants of saving suggested by a standard buffer stock model of saving can explain this finding. The three main determinants of household saving implied by such a model have a significant impact on the household saving ratio while their combined effect completely offsets its countercyclicality

KATARZYNA KOCHANIAK(2016)

impact of decreasing MFI interest rates on household deposits and saving goals in 12 Monetary Union member countries in the years 2009-2015. It analyses tendencies in household deposits (overnight, with agreed maturity and redeemable at notice), and attempts to link them with certain household saving motives (target, retirement and precautionary).

HILARY BOUDET(2016)

Household energy conservation often categorises targeted behaviours by their behavioural attributes (e.g., savings, cost, frequency). The most common distinction in the literature divides behaviours as follows: (1) low-impact, low-cost, repetitive behaviours that result in a loss of comfort or curtailment behaviours and (2) high-impact, high-cost, infrequent behaviours that result in no loss of amenities or efficiency behaviours.

ILEANA GABRIELA NICULESCU-ARON(2014)

The main sector of a national economy that saves is the household sector. Its saving behaviour is determined by a complex of economic, social, demographic and cultural factors. Their determination is of utmost importance for the foundation of the policies aimed at stimulating household savings. Identification of the main determinants of population savings is done using panel data for 6 European countries for the 1995-2010 period.

SHENGLONG LIU; ANGANG HU(2013)

We test the explanatory powers of Keynesian theory, the life-cycle hypothesis, and the precautionary saving theory on household saving in China, based on data from 1990 to 2009 from 31 provinces and autonomous regions. The results show that the precautionary saving motivation explains household saving

HOWELL H ZEE(2013)

The relationship between taxation and the household saving rate. On the basis of standard savings and tax revenue data from a sample of OECD countries, it provides compelling empirical evidence of a powerful impact of taxes on household savings. In particular, income taxes are shown to affect negatively the household saving rate much more than consumption taxes

MALHAR NABAR(2011)

It finds that the increase in urban saving rates is negatively associated with the decline in real interest rates over this period. This negative association suggests that Chinese households save with a target level of saving in mind. When the return to saving declines (increases), it becomes more difficult (easier) to meet a target and households increase (lower) their savings out of current disposable income to compensate.

GIACOMO CORNEO(2010)

The German government seeks to stimulate private retirement savings by means of special allowances and tax exemptions – the so-called Riester scheme. We apply matching and panel regression techniques to assess the impact of the Riester scheme on households’ propensities to save in a natural experiment framework. Estimation results from both the German Socio-Economic Panel and the SAVE study indicate that private saving was hardly affected by the introduction of the Riester scheme.

MOHSIN HASNAIN AHMAD(2007)

The present study investigates the behaviour of household saving by employing the Johansen-Juselius cointegration technique and error correction model to determine the long run and short run dynamics of the system respectively using “time-series” data for Pakistan over the period 1972-2003.

BARBARA LIBERDA(1999)

The author estimates determinants of household savings in Poland in the years 1994-1997. It turns out that the household saving rate depends strongly on household income. However, the household saving function from disposable income is not strictly linear. It ‘kinks’ upwards at the point where household income is 1.5 times higher

TIM CALLEN(1997)

household saving using data from 21 OECD countries for 1975-95. A particular focus is the influence of the tax and social security systems on household saving. The paper therefore extends the usual set of explanatory variables used to explain household saving behavior to include variables that capture the structure of the tax system and the financing and generosity of the social security and welfare system

METHODOLOGY

The research method followed here is empirical research. A total of 210 samples have been collected out of which all samples have been collected through convenient sampling methods. The sample frame taken here is public areas in and around Chennai. The independent variables are age, gender,education qualification, employment status, marital status. The dependent variables are primary reasons for saving money , financial emergencies that require the use of your savings , main Drawbacks of saving money , savings habits have impacted your overall financial wellbeing, government is planning properly in case of any emergencies statistical tools used here are spss, cluster bar chart, independent sample test. The impact of household saving is significant and can have wide-ranging effects on both individuals and the broader economy.

ANALYSIS

FIGURE 1

LEGEND

It is inferred from figure 1 that most of the respondents said that emergencies is the primary reason for saving money and most of them are in the age group of below 20 years

FIGURE 2

LEGEND

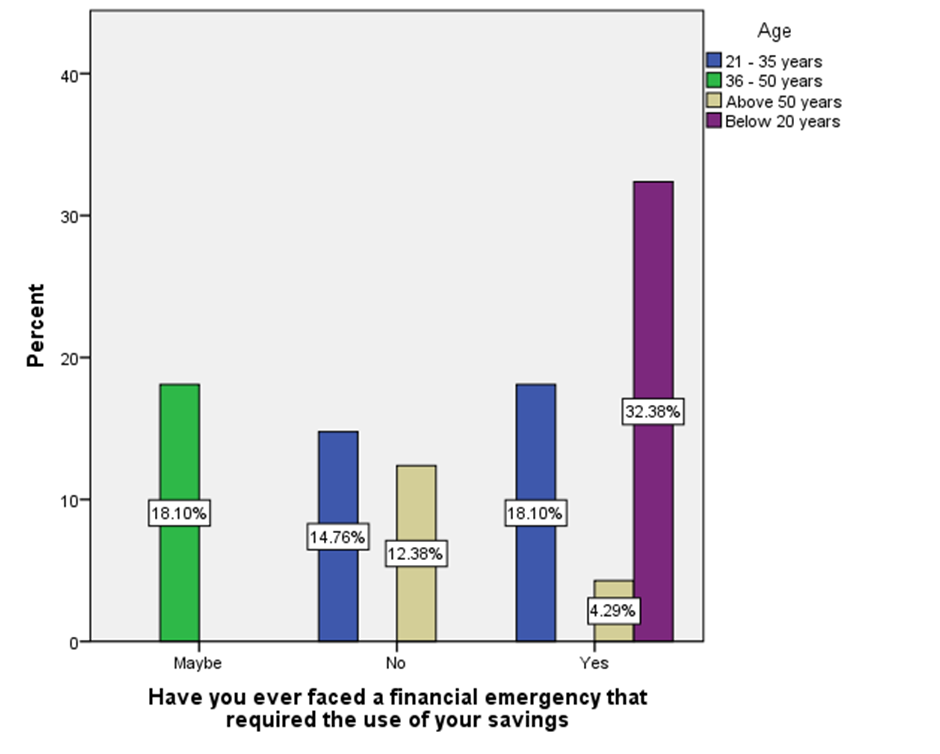

It is inferred from figure 2 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are in the age group of below 20 years

FIGURE 3

LEGEND

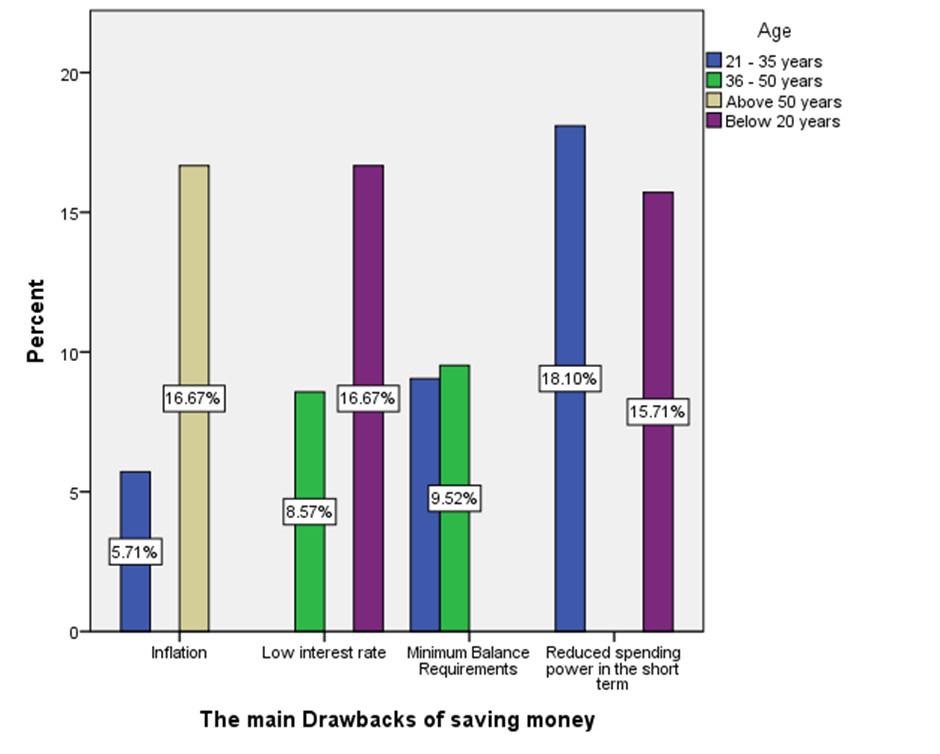

It is inferred from figure 3 reduced spending power in the short term is the main drawbacks of saving money and most of them are in the age group of below 21-35 years

FIGURE 4

LEGEND

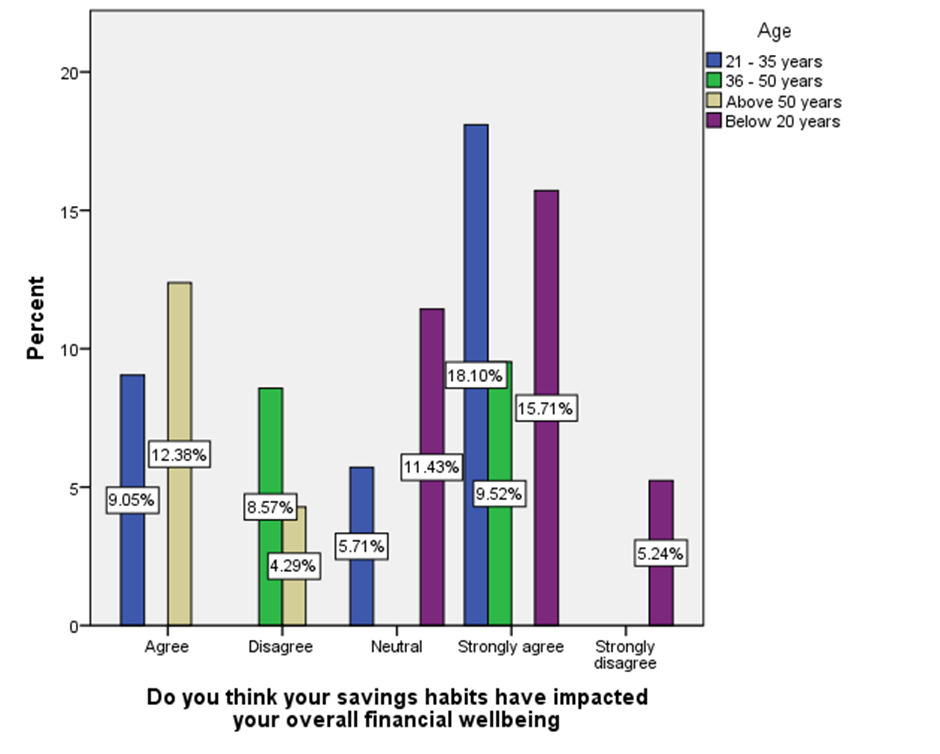

It is inferred from figure 4 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are in the age group of below 21-35 years

FIGURE 5

LEGEND

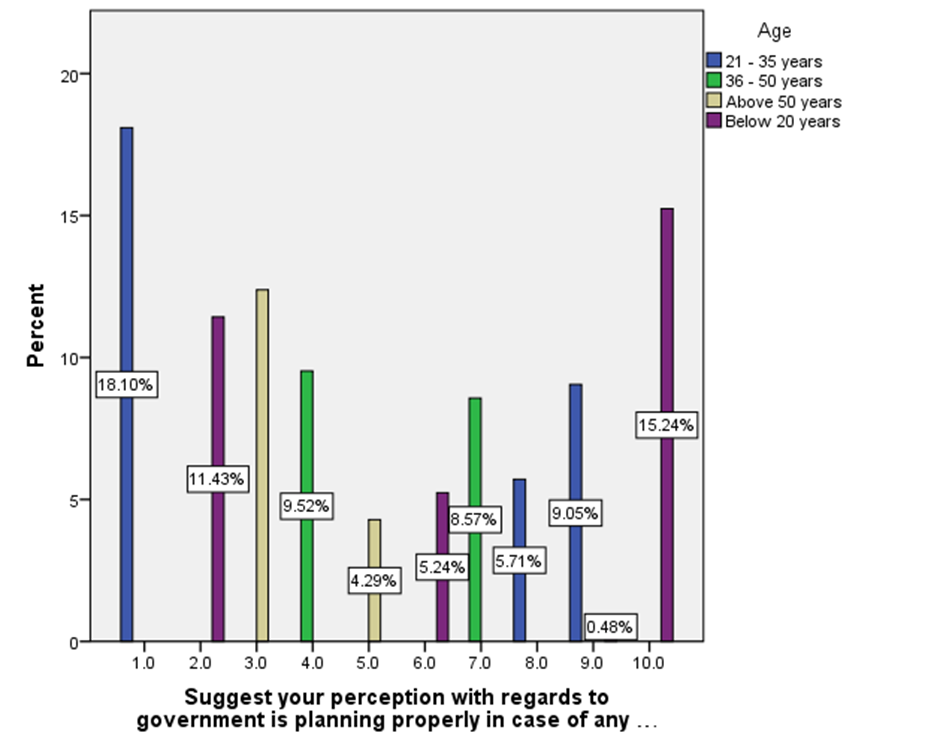

It is inferred from figure 5 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are in the age group of below 21-35 years

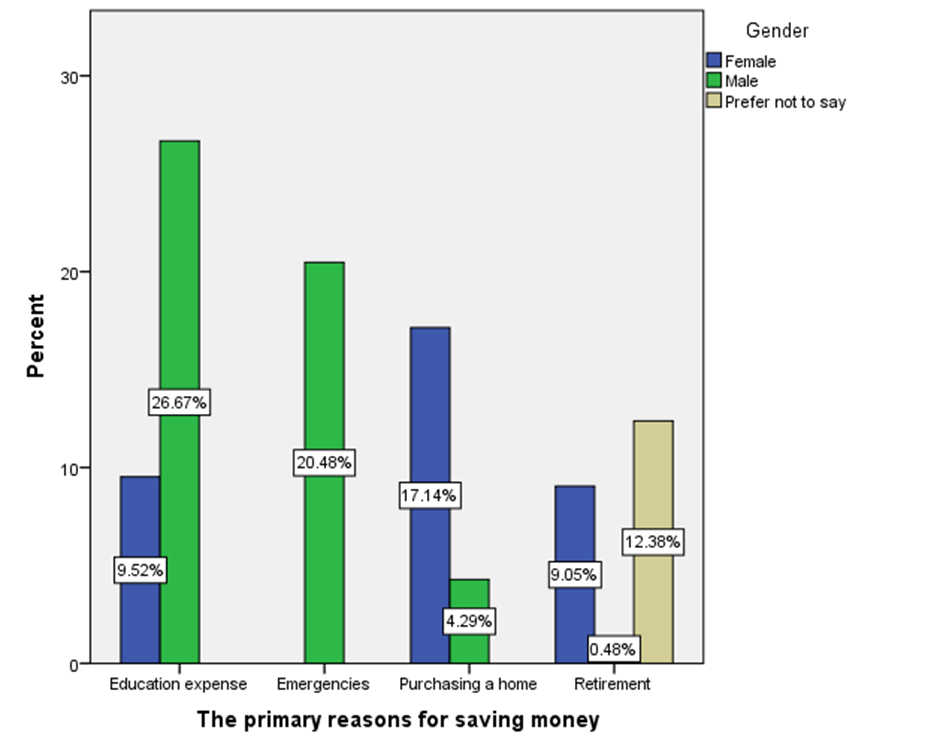

FIGURE 6

LEGEND

It is inferred from figure 6 that most of the respondents said that education expense is the primary reason for saving money and most of them are male

FIGURE 7

LEGEND

It is inferred from figure 7 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are female

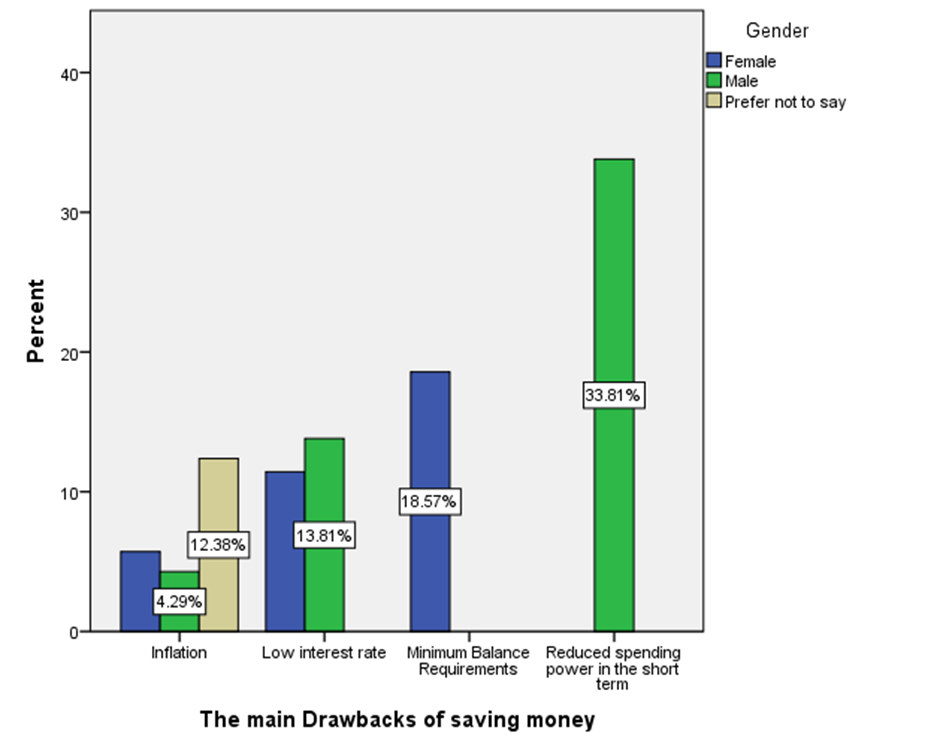

FIGURE 8

LEGEND

It is inferred from figure 8 reduced spending power in the short term is the main drawbacks of saving money and most of them are male

FIGURE 9

LEGEND

It is inferred from figure 9 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are male

FIGURE 10

LEGEND

It is inferred from figure 10 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are male

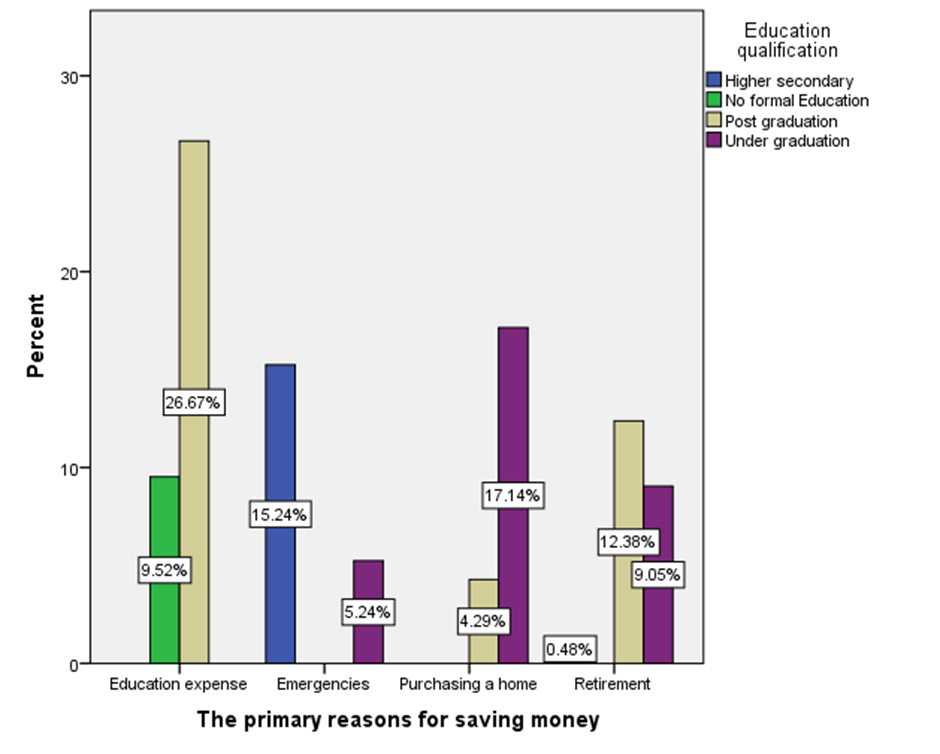

FIGURE 11

LEGEND

It is inferred from figure 11 that most of the respondents said that education expense is the primary reason for saving money and most of them are in post graduation

FIGURE 12

LEGEND

It is inferred from figure 12 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are in post graduation

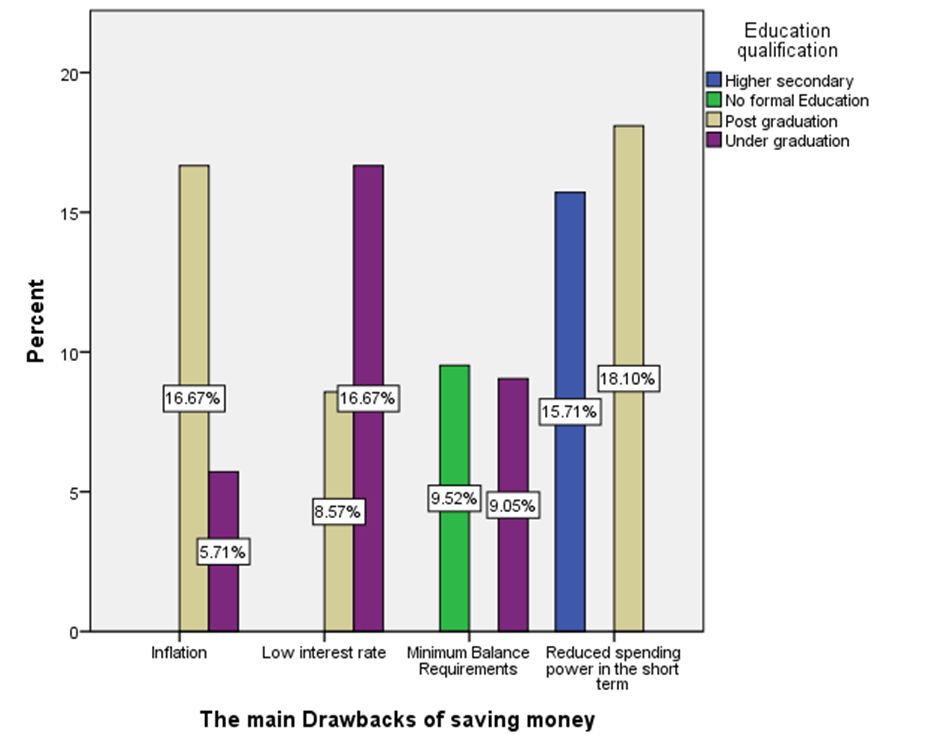

FIGURE 13

LEGEND

It is inferred from figure 13 reduced spending power in the short term is the main drawbacks of saving money and most of them are in post graduation

FIGURE 14

LEGEND

It is inferred from figure 14 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are in post graduation

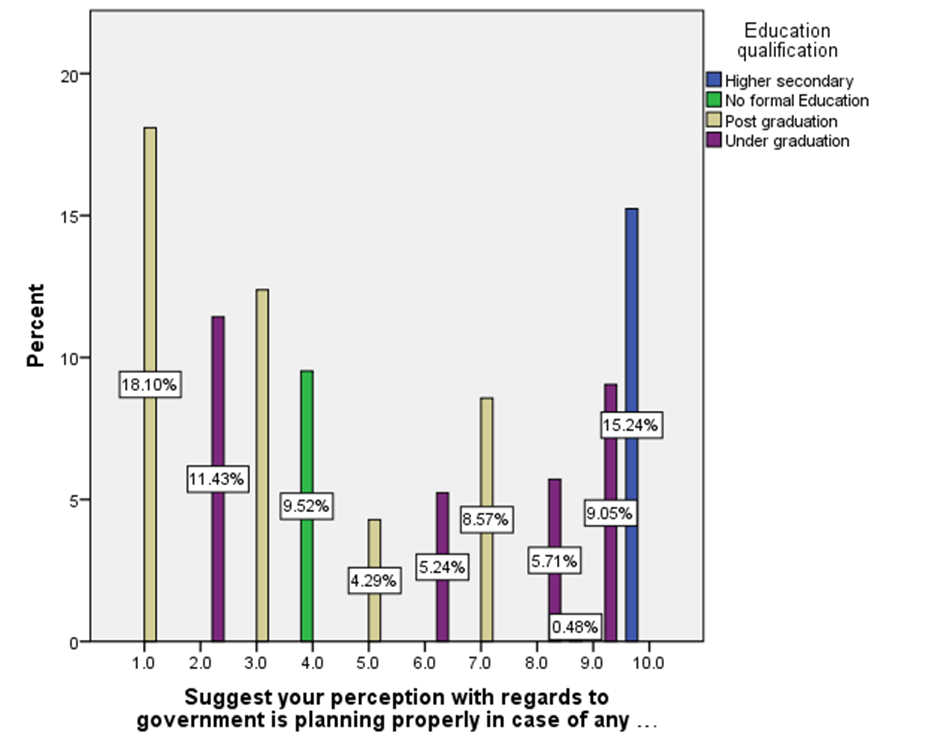

FIGURE 15

LEGEND

It is inferred from figure 15 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are in Post graduation

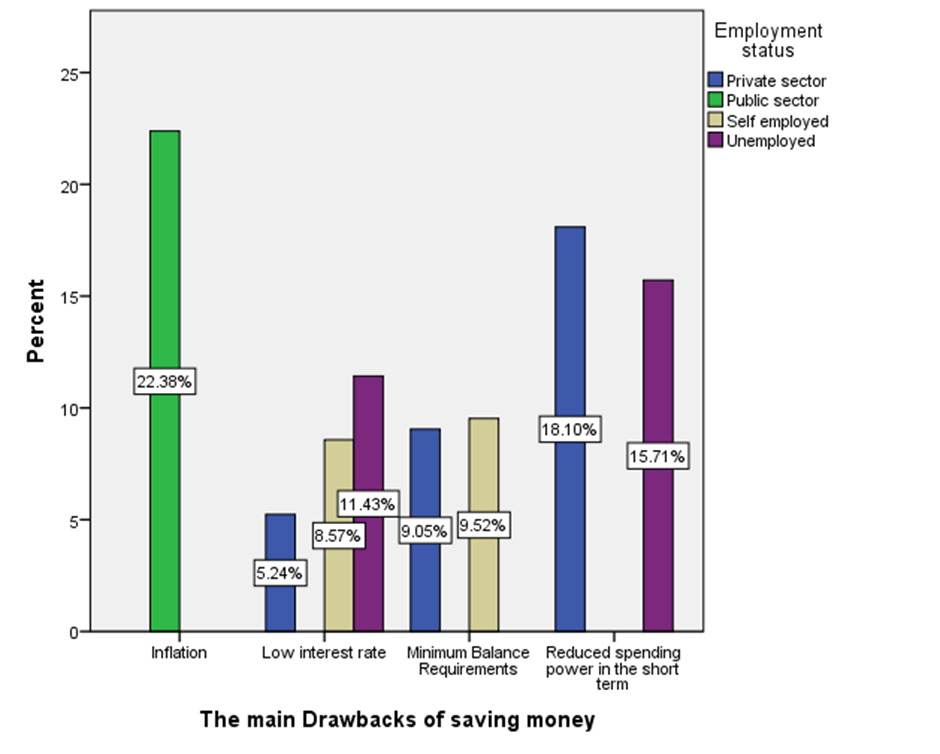

FIGURE 16

LEGEND

It is inferred from figure 16 that most of the respondents said that education expense is the primary reason for saving money and most of them are in private sector

FIGURE 17

LEGEND

It is inferred from figure 17 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are In unemployed

FIGURE 18

LEGEND

It is inferred from figure 18 inflation is the main drawbacks of saving money and most of them are in public sector

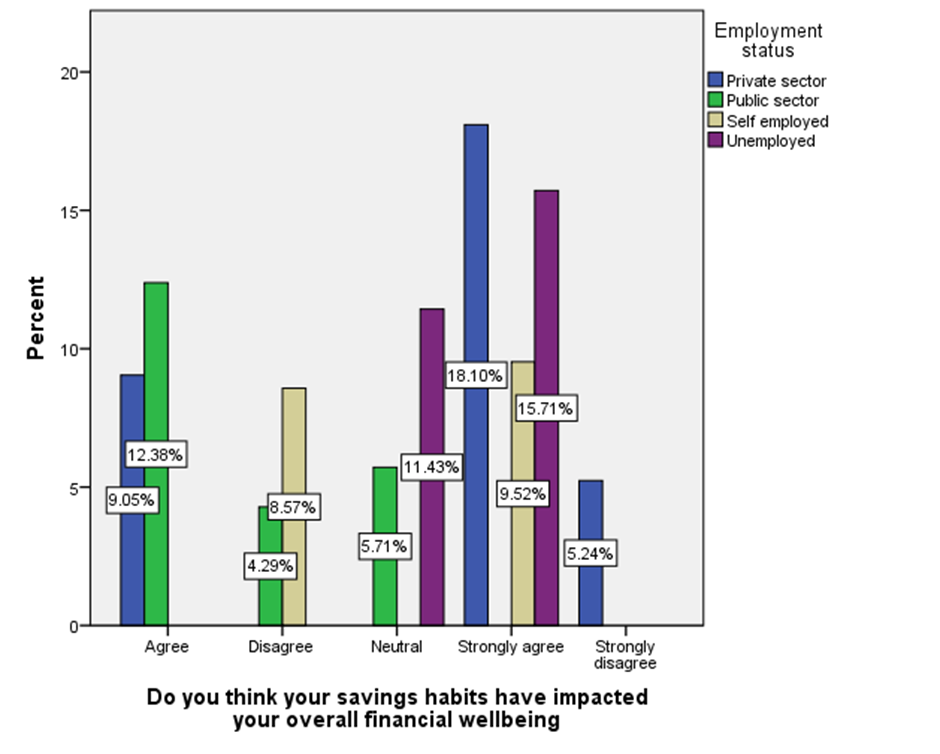

FIGURE 19

LEGEND

It is inferred from figure 19 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are in private sector

FIGURE 20

LEGEND

It is inferred from figure 20 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are in private sector

RESULT

It is inferred from figure 1 that most of the respondents said that emergencies is the primary reason for saving money and most of them are in the age group of below 20 years at 20.48%

It is inferred from figure 2 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are in the age group of below 20 years at 32.38%

It is inferred from figure 3 reduced spending power in the short term is the main drawbacks of saving money and most of them are in the age group of below 21-35 years

It is inferred from figure 4 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are in the age group of below 21-35 years at 18.10%

It is inferred from figure 5 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are in the age group of below 21-35 years at 18.10%

It is inferred from figure 6 that most of the respondents said that education expense is the primary reason for saving money and most of them are male at 26.67%

It is inferred from figure 7 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are female at 43.33%

It is inferred from figure 8 reduced spending power in the short term is the main drawbacks of saving money and most of them are male at 33.81%

It is inferred from figure 9 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are male at 33.81%

It is inferred from figure 10 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are male at 18.10%

It is inferred from figure 11 that most of the respondents said that education expense is the primary reason for saving money and most of them are in post graduation at 26.67%

It is inferred from figure 12 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are in post graduation at 22.38%

It is inferred from figure 13 reduced spending power in the short term is the main drawbacks of saving money and most of them are in post graduation at 18.10%

It is inferred from figure 14 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are in post graduation at 18.10%

It is inferred from figure 15 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are in Post graduation at 18.10%

It is inferred from figure 16 that most of the respondents said that education expense is the primary reason for saving money and most of them are in private sector at 18.10%

It is inferred from figure 17 that most of them said yes for that they faced financial emergency that required the use of your savings and most of them are In unemployed at 27.14%

It is inferred from figure 18 inflation is the main drawbacks of saving money and most of them are in public sector at 22.38%

It is inferred from figure 19 that most of them strongly agreed towards the saving habits have impacted their overall financial wellbeing and most of them are in private sector at 18.10%

It is inferred from figure 20 that most of them rated 1.0 towards the government is planning properly in case of any emergencies and most of them are in private sector at 18.10%

DISCUSSION

Figure 1 suggests that a significant proportion of respondents, particularly those under 20 years old, prioritise emergency savings. This indicates a growing awareness among young people about the importance of financial preparedness for unexpected events. It’s possible that this age group has a higher perceived risk of emergencies due to factors such as limited financial stability and a greater likelihood of experiencing unforeseen expenses like medical bills or accidents.Further research could explore the specific types of emergencies that young people perceive as most likely and the factors influencing their decision to prioritise emergency savings.

Figure 2 indicates that a substantial portion of respondents, especially those under 20 years old, have encountered financial emergencies that necessitated dipping into their savings. This suggests a significant level of financial vulnerability among this age group. It’s possible that unforeseen expenses related to education, healthcare, or family emergencies are common drivers for using savings. Further analysis could delve into the specific types of financial emergencies faced by this demographic and the impact on their overall financial well-being.

Figure 3 suggests that a significant portion of respondents, particularly those in the younger age group of 21-35, perceive reduced spending power in the short term as the primary drawback of saving money. This finding aligns with the common perception that saving can limit immediate spending on desired goods or experiences. It’s possible that this age group faces pressures to maintain a certain lifestyle or meet short-term financial obligations, making them more hesitant to sacrifice current spending for future savings. Further research could explore the specific factors influencing this preference and the potential trade-offs between short-term spending and long-term financial security.

Figure 4 suggests a significant portion of respondents, particularly those in the younger age group of 21-35, strongly believe that their saving habits have positively impacted their overall financial well-being. This indicates a growing awareness among young people of the importance of financial planning and the long-term benefits of saving. It’s possible that this age group is more likely to be in the early stages of their financial journeys, and the positive impact of their savings habits is more pronounced. Further research could explore the specific ways in which saving has benefited this demographic, such as building an emergency fund, reducing debt, or achieving financial goals like homeownership or education.

LIMITATIONS

One of the major limitations of the study in the sample frame. There is a major constraint in the sample frame as it is limited to a small area. Thus, it proves to be difficult to extrapolate it to a larger population. Another limitation is the sample size of 210 which cannot be used to assume the thinking of the entire population in a particular country, state, or city. The physical factors have a larger impact, thus, limiting the study.

CONCLUSION

The impact of household saving is significant and can have wide-ranging effects on both individuals and the broader economy. By saving, households can build wealth, prepare for unexpected expenses, and plan for long-term financial goals such as retirement. Additionally, saving can contribute to economic growth by increasing the availability of funds for investment and reducing reliance on debt. At the same time, the impact of household saving can be influenced by a wide range of factors, including economic conditions, cultural norms, government policies, and individual characteristics such as income and debt levels. Understanding these factors and their impact on saving behaviour is important for individuals and policymakers who seek to promote saving and help households achieve greater financial security.

Household saving plays a crucial role in the economic landscape, influencing both individual financial stability and broader economic health. At the individual level, savings serve as a financial buffer against unforeseen circumstances such as job loss, medical emergencies, or unexpected expenses. By maintaining a safety net, households can avoid debt accumulation and ensure a more secure standard of living, which fosters overall well-being.

On a macroeconomic scale, household savings are vital for capital formation and investment. High savings rates contribute to the availability of funds for banks and financial institutions, which can then be lent to businesses for expansion and innovation. This cycle of saving and investment is essential for economic growth, as it stimulates job creation and enhances productivity. Furthermore, increased household savings can lead to greater financial stability for the economy, reducing vulnerability during economic downturns.

However, while household saving is beneficial, it must be balanced with consumption to ensure sustained economic growth. Excessive saving can lead to decreased demand for goods and services, potentially slowing down economic activity. Policymakers often grapple with this dynamic, seeking to encourage responsible saving while promoting consumption to drive growth.

In conclusion, the impact of household saving is multifaceted, contributing to personal financial security and the overall economic framework. Effective policies that promote saving while fostering consumption are essential for achieving balanced and sustainable economic development. As households continue to navigate financial challenges, the importance of cultivating a culture of saving cannot be overstated, serving as a foundation for resilience and prosperity both at the household and national levels.

REFERENCE

The impact of demography, growth and public policy on household saving: a case study of Pakistan Mohsin Hasnain Ahmad; Zeshan Atiq; Shaista Alam; Muhammad Sabihuddin Butt; DOI: 10.18356/8517ea89-en Published: 05 Apr 2007 Journal: Asia-Pacific Development Journal, volume 13, issue 2 December, pages 57-71

The Impact of Pre-Marital Sex Ratios on Household Saving in Two Asian Countries: The Competitive Saving Motive Revisited

Authors: Charles Yuji Horioka; Akiko Terada-Hagiwara; DOI: 10.2139/ssrn.2805799

Rahmanda Muhammad Thaariq; Arif Anindita; Hafizha Dea Iftina; DOI: 10.21098/bemp.v24i2.1650 THE INTERNET MIRACLE: THE IMPACT OF INTERNET ACCESS ON HOUSEHOLD SAVING IN INDONESIA

Household Saving in China: The Keynesian Hypothesis, Life-Cycle Hypothesis, and Precautionary Saving Theory Authors: Shenglong Liu; Angang Hu; DOI: 10.1111/deve.12026

University of Warsaw – Faculty of Economic Sciences, Poland

Household Saving in Poland Authors: Barbara Liberda; DOI: 10.2139/ssrn.1447862 ;

Is the Age Structure of the Population One of the Determinants of the Household Saving Rate in China? A Spatial Panel Analysis of Provincial Data

Authors: Jingwen, Yin; Charles, Yuji Horioka; DOI: 10.2139/ssrn.4053208 Publisher: Elsevier BV

Do Habitual Energy Saving Behaviors of Household Heads Impact Energy Consumption in Their Own Dwelling? An Exploration in the French Residential Sector Adan L. Martinez-Cruz; Dorothée Charlier; DOI: 10.2139/ssrn.3577223

The Impact of Individual Behavior on Household Energy Saving

Authors: Gulshan Maqbool;Zulqarnain Haider;

DOI: 10.52223/jei3012105 Publisher: Science Impact Publishers

Demographic and Social Determinants on Household Saving Rate in the Former Socialist Countries (Central and Eastern Europe)

Ileana Gabriela Niculescu-Aron; Constanta Mihaescu;

DOI: 10.1016/s2212-5671(14)00283-4 Published: 01 Jan 2014

Impact of Foreign Capital Inflows on Household Savings in Pakistan

Muhammad Idrees;Ayesha Khan; Muhammad Arsalan Khan; Muhammad Bilal Raees; Muniza Syed; DOI: 10.24018/ejbmr.2020.5.4.436

Published: 22 Jul 2020 Journal: European Journal of Business and Management Research, volume 5 (eissn: 2507-1076,

Data for: Business cycle fluctuations and household saving in OECD countries: A panel data analysis Adema, Yvonne; DOI: 10.17632/kwynnv2cz7.1 Published: 30 Nov 2016

The Impact of House Prices on Consumption in the UK: a New Perspective

Vivien Burrows; DOI: 10.1111/ecca.12237,Published: 11 May 2017 Journal: Economica, volume 85, pages 92-123 (issn: 0013-0427

Assessing the household saving behavior of urban and rural households in Pakistan: Evidence from PSLM/HIES 2018-19

Maria Aslam; Sehar Saleem; Warda Mukhtar; Rehana Firdous;

DOI: 10.52131/pjhss.2022.1004.0299 Published: 31 Dec 2022 Journal: Pakistan Journal of Humanities and Social Sciences, volume 10 (issn: 2709-801X, eissn: 2415-007X

Low interest rates – do they revise household saving motives in the Euro area?

Katarzyna Kochaniak; DOI: 10.1515/fiqf-2016-0135 HANDLE: 10419/197427 Published: 01 Jul 2016 Journal: e-Finanse, volume 12, issue 1

Low interest rates – do they revise household saving motives in the Euro area?

Katarzyna Kochaniak DOI: 10.1515/fiqf-2016-0135 HANDLE: 10419/197427

Published: 01 Jul 2016 Journal: e-Finanse, volume 12, issue

Demographics and Aggregate Household Saving in Japan, China, and India

Chadwick C. Curtis; Steven Lugauer; Nelson C. Mark; DOI: 10.1016/j.jmacro.2017.01.002

Empirical Determinants of Household Saving: Evidence From OECD Countries Tim Callen;Christian Thimann; DOI: 10.5089/9781451859157.001 , 10.2139/ssrn.883935 Published: 01 Dec 1997 Journal: IMF Working Papers, volume 97, page 1 (issn: 1018-5941

The effect of saving subsidies on household saving: Evidence from Germany

evidence from Germany Giacomo Corneo; Matthias Keese;

Carsten Schröder; DOI: 10.17169/fudocs_document_000000005073 , 10.2139/ssrn.1592453 HANDLE: 10419/30318

Taxation and the household saving rate: evidence from OECD countries

Howell H Zee; Vito Tanzi; DOI: 10.13133/2037-3643/10345 , 10.2139/ssrn.882279 , 10.5089/9781451845426.001 Published: 10 May 2013 Journal: PSL Quarterly Review, volume 53, issue 212, pages 31-43 (issn: 2037-3635, eissn: 2037-3643

Targets, Interest Rates, and Household Saving in Urban China

Malhar Nabar; DOI: 10.5089/9781463904258.001 , 10.2139/ssrn.1934660

Published: 01 Jan 2011 Journal: IMF Working Papers, volume 11, page 1 (issn: 1018-5941, Publisher: International Monetary Fund (IMF)

Clustering household energy-saving behaviours by behavioural attribute

Hilary Boudet; June A. Flora; K. Carrie Armel; DOI: 10.1016/j.enpol.2016.02.033 Published: 01 May 2016 Journal: Energy Policy, volume 92, pages 444-454 (issn: 0301-4215